Do you qualify for a stimulus check in Senate’s coronavirus response bill?

One of the cornerstones of the Senate coronavirus stimulus package is the direct payment of money from the federal government to American individuals and families. If you look in the

One of the cornerstones of the Senate coronavirus stimulus package is the direct payment of money from the federal government to American individuals and families.

If you look in the middle of the bill’s hundreds of pages, you can find details in regards to who can expect to receive money and how much they can expect. Down below is the breakdown.

Who is eligible?

The bill clearly states that everyone is eligible except for nonresident aliens and those who may qualify for as the basis for another person.

“Seniors, veterans, the unemployed and low-income Americans would be eligible too,” Senate Finance Committee Chairman Chuck Grassley said Wednesday.

The bill text states that those who receive social security can collect checks: For those not required to file 2018 or 2019 tax returns due to social security benefits, do not need tax returns to claim the money. The government can use information from a Form SSA-1099, Social Security Benefit Statement, or Form RRB-1099, Social Security Equivalent Benefit Statement.

People filing individually

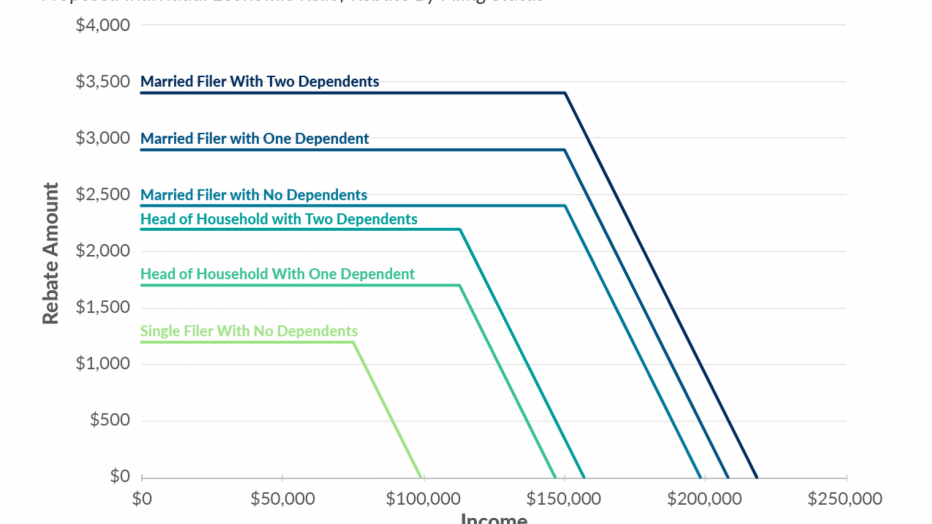

People who file their taxes as individuals are eligible for payments up to $1,200, but the amount will decrease for people who earn more than $75,000 a year. The bill stated that refunds are going to reduce by five percent of every dollar above that mark or $50 for $1,000 over $75,000.

People who make more than $75,000 the payment is less the higher their earning is, may reduce to zero for those who make $99,000 or more.

People filing jointly

Couples who file a joint tax return are eligible for a payment of up to $2,400 with an additional $500 per child. This amount will decrease for couples who attain more than $150,000 in a year at the same rate of 5 percent of every dollar above that mark.

For people filing jointly, this translates to less money the more people make, with it being reduced to zero for joint filers without children who earn $198,000.

People filing as heads of households

People who file as heads of households are eligible for payments of up to $1,200 with an additional $500 per child. The amount decreases for people who make attain more than $112,000 a year. The amount decreases based on the number of children you have, as illustrated in the graph below, provided by the Tax Foundation.

Income on people’s tax filings for 2019 was not for that year, then their filing for 2018 applies.

“If the individual has not filed a tax return for such individual’s first taxable year beginning in 2018,” the bill says, the information should be used for 2019 provided in their SSA-1099 or RRB-1099 Social Security Benefit Statements.

When and how are payments made?

According to the bill, payments will be “as rapidly as possible” and no later than Dec 31, 2020. Fees are going made via direct deposit to an account the person has authorized for tax refunds or federal payments on or after Jan 1, 2018.

A notice will be sent to the person’s last known address within 15 days of payment with detail about the method and amount of debt. A phone number will be available for people to can call the IRS in a case when they did not receive it.