Coronavirus relief money went to companies that were not paying US taxes

The federal government’s rescue program for small businesses affected by the coronavirus pandemic is reportedly doling out millions of dollars in taxpayer money to firms that have dodged paying U.S. taxes.

The federal government’s rescue program for small businesses affected by the coronavirus pandemic is reportedly doling out millions of dollars in taxpayer money to firms that have dodged paying U.S. taxes.

A recent Reuters report found that 110 publicly traded companies have received a forgivable loan of at least $4 million through the Paycheck Protection Program. At least 46 of those companies did not pay the U.S. corporate tax in 2019, although the reason was not always tax avoidance.

Out of the companies subject to taxes, 12 recently used offshore havens to cut their tax bills, the Reuters analysis found. As a result., these 12 companies received over $104 million in loans from American taxpayers. Seven paid no U.S. tax at all for the past year.

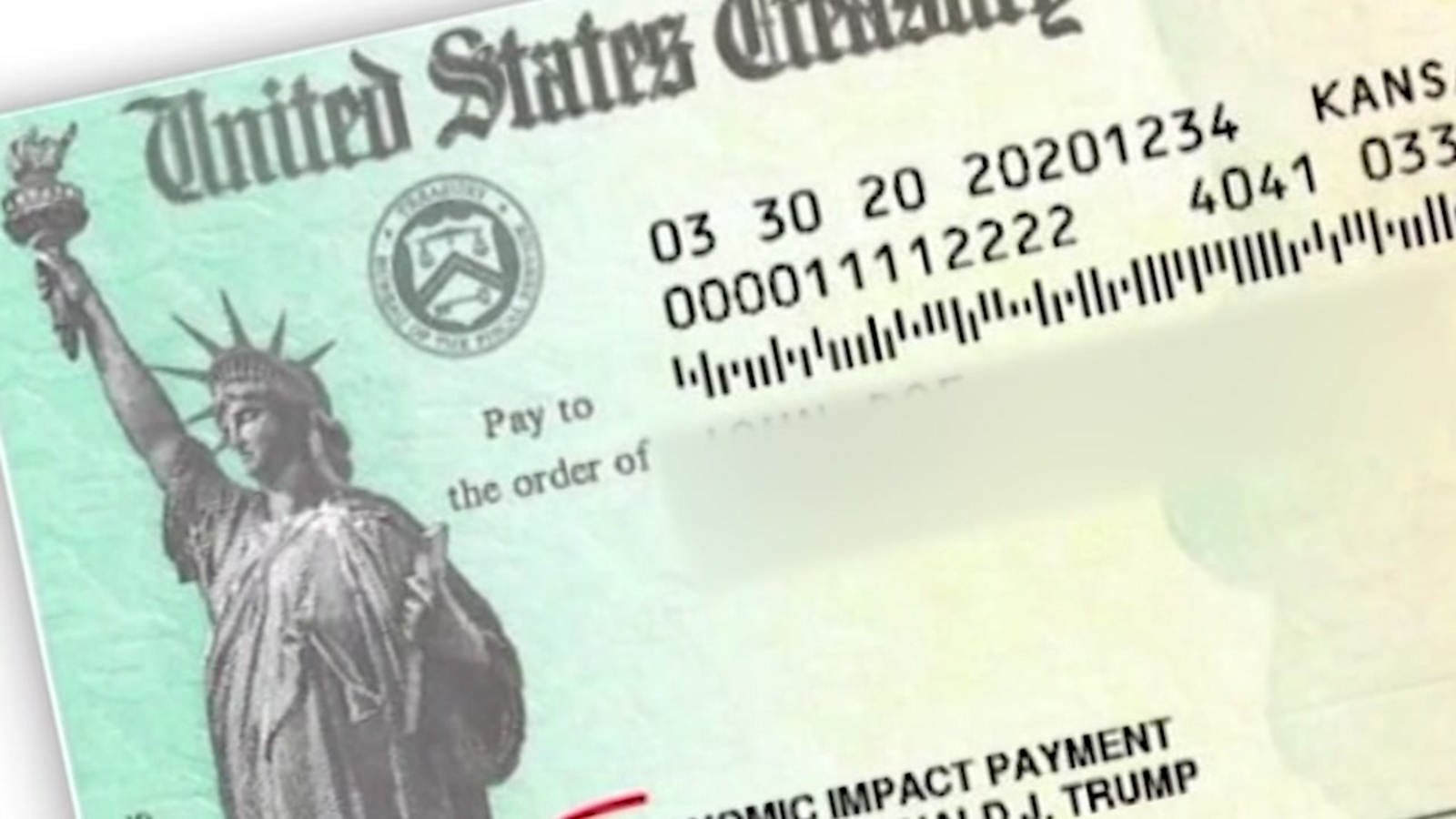

The Paycheck Protection Program, a centerpiece of the $2.2 trillion CARES Act signed into law at the end of March, provides low-interest loans of up to $10 million to businesses with fewer than 500 workers affected by the coronavirus pandemic. For the loans to be forgiven, companies will have to adhere to strict requirements, for instance, putting at least 75 percent of the money toward maintaining payroll and using up the loan within eight weeks.

The second round of PPP funding began April 27 after the initial tranche of $349 billion evaporated in just 13 days — in part because large; public companies received multimillion-dollar loans. A firestorm of criticism over big companies taking advantage of the program prompted the Treasury Department to tighten the rules over which companies were eligible for loans.

At least 428 public companies received forgivable loans totaling more than $1.36 billion from the program, according to Washington D.C.-based data analytics firm FactSquared. Of those companies, 68 have returned the money, approximately $435 million.

As of Saturday, more than 4.42 million loans worth close to $511 billion had been distributed through the program. Congress allocated about $610 billion to the PPP, leaving almost $100 billion left over in the fund.

There’s no evidence that loan recipients that channeled profits offshore have broken tax laws or violated the PPP rules, which does not explicitly address tax avoidance.

According to Reuters, Zagg, a Utah-based company that makes mobile device accessories, received a loan worth $9.4 million. The company, which employs 528 people, including 479 in the U.S., told Reuters the money would play “a critical role in ensuring we have our team in place as the economy reopens.”

However, Zagg last year received a $3.3 million tax refund and racked up U.S. tax credits worth $7 million, Reuters reported. Although it made $6 million in profit, it did not pay American taxes.

That’s because the company books a slew of its profits through small companies in places like Ireland and the Cayman Islands. Its parent company, Patriot Corporation, is based in Ireland, where the corporate tax rate is 12.5 percent.

Companies registered in Ireland can pick up another country as their tax domicile. Patriot is tax-resident in the Cayman Islands, where there is no corporate tax rate.